A recently published study by Complementa shows that large parts of the returns achieved by institutional investors and the corresponding portfolio volatility can be explained by the investment strategy. However, an investment strategy should not only be defined within an ALM study, but it also needs to be implemented. In addition to careful investment product selection, this also includes appropriate risk management. Rebalancing concepts can be considered one aspect of risk management. Rebalancing frameworks provide guidelines on how to reestablish the target weights for different investment categories and thereby restoring the risk/return characteristics of the chosen strategic asset allocation. Rebalancings can be applied to all categories of the portfolio or just individual investment categories. Rebalancing concepts ensure that gains are captured in positive markets and the re-entry points are not missed during market downturns. This also ensures that the tracking error relative to the defined investment strategy does not get too large over time. On the following pages, we will look at various aspects of rebalancing concepts.

Which dimensions are usually specified in rebalancing concepts?

Often the following three dimensions are defined when determining rebalancing concepts:

- Frequency: corresponds to the time frame over which a rebalancing review is carried out.

- Bandwidths: Defines the thresholds at which the rebalancing must be carried out and thus reflects the risk tolerance. Generally, an upper and lower bandwidth is defined for each investment category.

- Mechanism: Specifies which categories must be rebalanced back to the targets in the event of a rebalancing. In the event of a breach, should all categories be rebalanced to the strategy (if possible) or only those that breach the bandwidths?

The design of rebalancing concepts is heterogeneous, with purely frequency-based concepts, pure range bandwidth concepts and mixed forms.

Which key factors influence the dimensions of rebalancing concepts?

The above-mentioned dimensions are influenced by various factors. These essentially include costs (e.g. transaction and operating costs), volatility and correlation of the asset classes as well as potential tax consequences. It should also be considered that different asset classes are tradable to varying degrees. In the case of unlisted infrastructure investments, for example, rebalancing is not possible or only with a significant time delay or only at a discount. Accordingly, the implementation of a rebalancing concept is also significantly influenced by the degree of illiquidity of the portfolio. The influence of the various factors also depends on the relative risk tolerance and strategic orientation of an investor. As a result, specifications for rebalancing concepts have to be tailored to the needs of the individual investor and can therefore, vary from one investor to another.

What is the effect of different rebalancing concepts in different time periods?

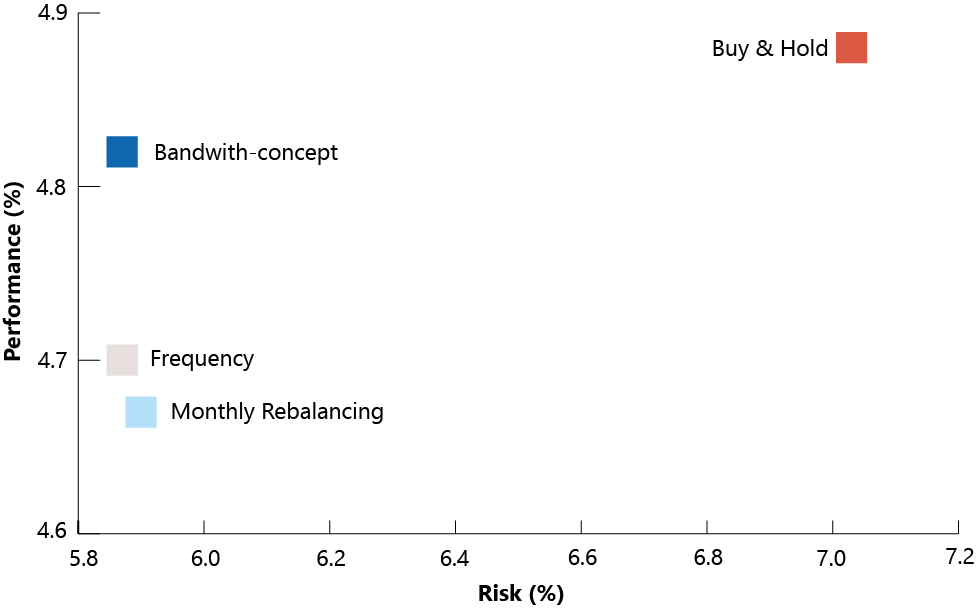

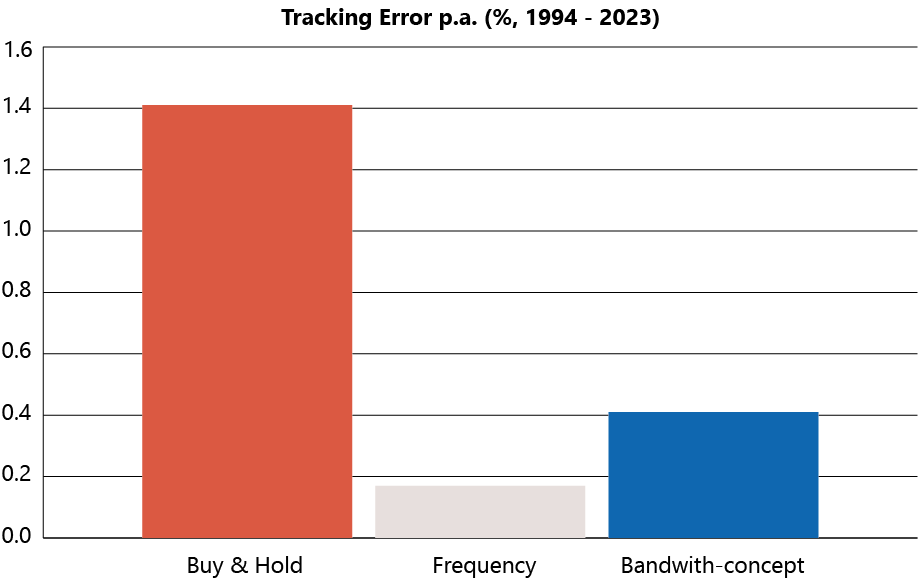

To illustrate the influence of different rebalancing concepts, various concepts were analysed. The analysis was based on the average asset allocation from the Complementa Risk Check-up Study 2023. The main observation period was from 1994 to 2023 (30 years). The analysis compared the results of a buy-and-hold strategy, concepts with monthly and quarterly rebalancing and a pure bandwidth approach.

Over the period from 1994 to 2023, the buy-and-hold strategy is characterized by a higher return, but also significantly higher risk (volatility) as well as the highest deviation risk (tracking error). The long-term comparison shows that the drawdowns were higher than in the other concepts, particularly during the dotcom bubble (2000 to 2002) and the global financial crisis (2007 to 2009). This is primarily due to the greater volume of risky assets at the beginning of these crises. An analysis of the individual market downturns also shows that approaches which increased equities and other risky assets during downturns perform better, as they participated in the following market recovery. In such a case, the rebalancing decision must also be considered in the context of the given ability to take risk.

Additionally, the analysis shows that a monthly rebalancing concept is not advantageous due to higher trading and operating costs. It is worth pointing out that quarterly or semi-annual rebalancing can be combined with a bandwidth concept. All the analysed rebalancing concepts have a more strategy-oriented risk profile than the pure buy-and-hold strategy. Narrower bandwidths and shorter time intervals incur higher costs due to an increased volume of reallocation measures, but they also tend to be closer to the strategy in terms of deviation risks and risk characteristics.

The design of the time interval or the choice of bandwidths depends on the investor’s relative risk tolerance to deviations from the investment strategy, the average level of rebalancing costs and the chosen investment strategy. The implementation of rebalancing concepts as opposed to a pure buy-and-hold strategy is generally worth considering, especially if various risk dimensions are considered.

Authors

Valentin Dietschweiler, CFA & Tseten Gyalzur, CFA