Investment Reporting

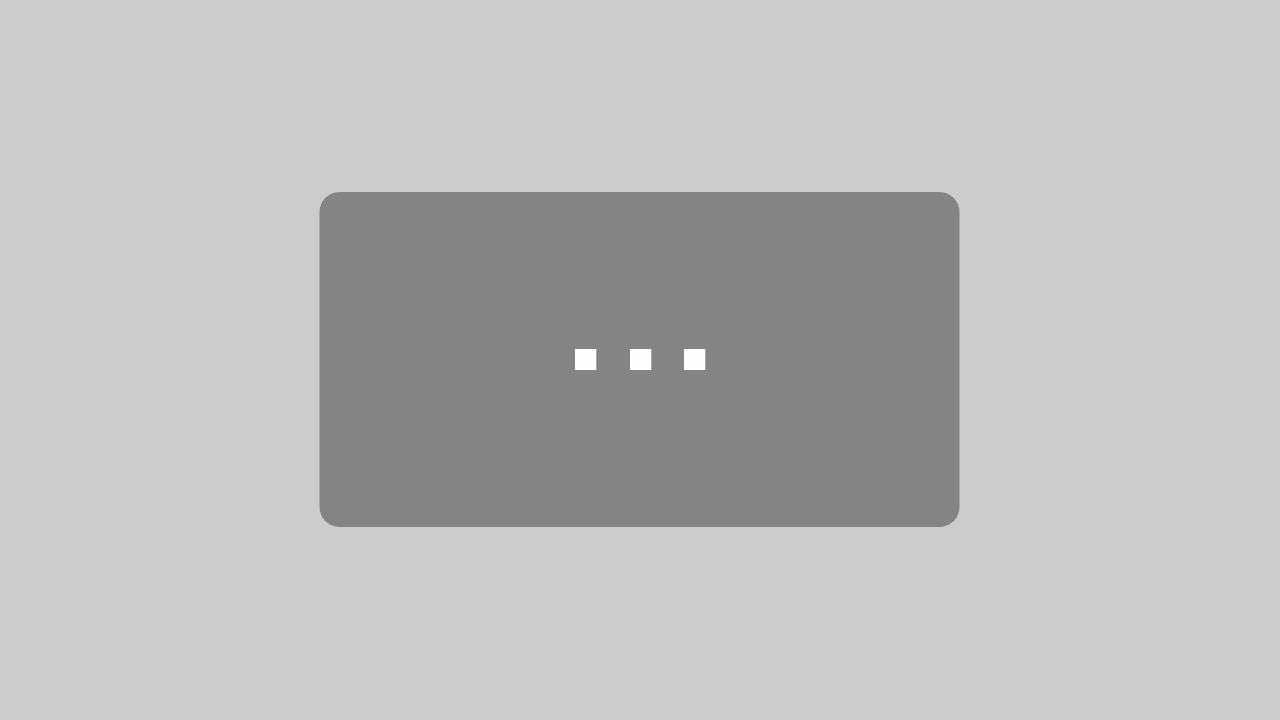

Our investment reports create transparency – thus a comprehensive, objective decision-making instrument for investors and executives. We flexibly consolidate assets in a multibank set-up and combine data management with both in-depth and client-specific analyses.

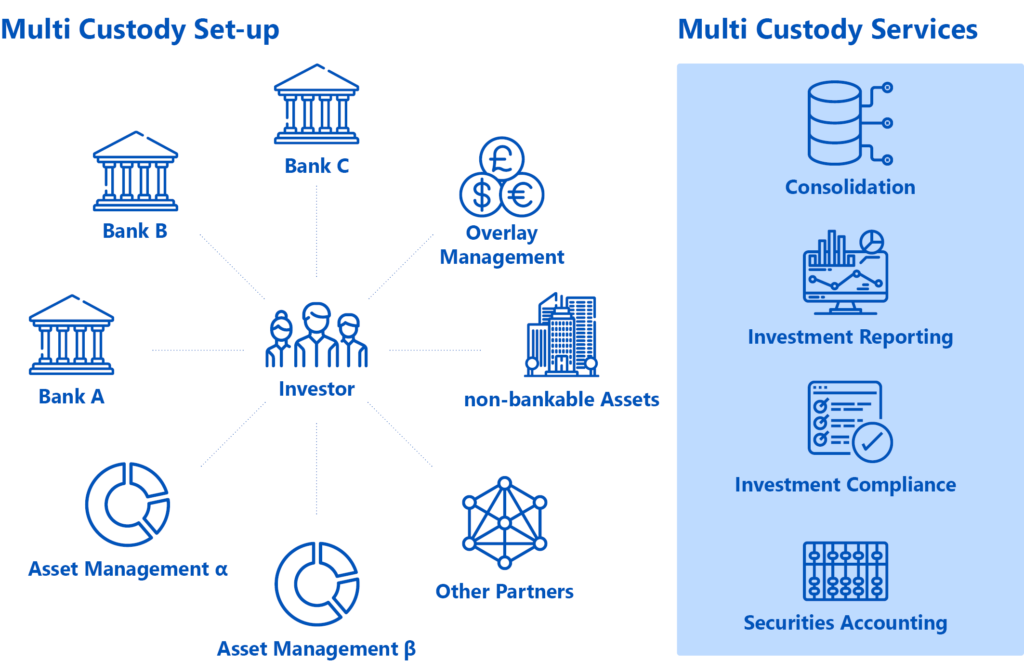

Clients profit from a professional multi custody (multibanking) consolidation service across banks and assets classes thanks to tailor made investment reports. Our specialists integrate non-bankable assets and report financial metrics across all asset classes, managers, banks etc. Besides performance and risk reporting, benchmark and peer group comparisons, the reporting of limited partnerships in accordance with IRR is becoming more and more important to clients with the highest demands for transparency. They further rely on our expertise to report currency effects and overlay activities, provide look through information and check the compliance with regulatory legislation or investor-specific requirements.

Investors also benefit from customized in-detph analyses by our experienced experts as well as from our latest service developments in the areas of sustainability (ESG reporting) and Swiss Solvency Test.

With our tools, clients can keep track of their investments anytime and anywhere: By means of the “Portfolio Analyzer”, we combine asset consolidation and periodic reporting with flexible online access and analysis tools. Professional investment managers may also access the portfolio management software directly using comprehensive analysis instruments.

Flexible Consolidation & Aggregation

Flexible Consolidation & Aggregation Risk & Performance

Risk & Performance Private Equity Reporting (IRR)

Private Equity Reporting (IRR) Investment Compliance

Investment Compliance Available anytime & anywhere

Available anytime & anywhere