The investment mix of pension funds has changed noticeably in recent years and has become riskier. Real estate and alternative investments in particular have risen in importance, as the Complementa risk check-up study shows. However, newly permitted asset classes will not be game changers.

Article: Read this one and more interesting articles online in the 15th 'Asset Manager' edition.

Despite disagreements regarding pension reform, countless pension funds have reported excellent performance results for the past year over the past days and weeks. According to preliminary projections, we expect an average return of 8.9 percent for domestic pension funds in 2021. The coverage ratio climbed by around 5.7 percentage points to almost 116 percent. Pension funds are therefore moving away from corona-related market turbulence, as seen with the markets being volatile in the new year and their performance at the beginning of the year showing negative signs. We see this as a starting point to shed light on long-term changes in investment behavior. For this purpose, we use surveys and projections carried out by the Complementa Risk Check-up, an annual study conducted among pension funds.

Trends leading towards more risks

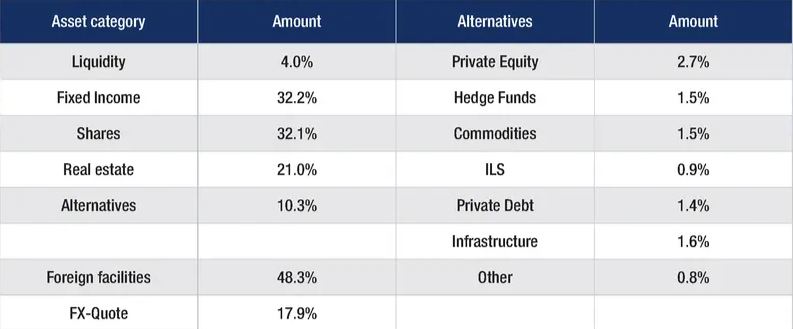

Due to the low level of interest rates, bond holdings were severely reduced in the last decade. While around 48 percent were still held in fixed-income investments or as liquidity in 2010, they were significantly lower at the end of 2021 at 36.2 percent. The funds released were distributed among equities, foreign real estate and alternative investments such as private equity, infrastructure investments and private debt. The real estate ratio has repeatedly been above 20 percent. Maintaining this level can pose challenges for pension funds in times of rising markets. On one hand, we observe a steady expansion of the share of global real estate, as well as a shift from direct to indirect implementation in the Swiss real estate sector; as a result of this, direct and indirect implementations are currently almost synonymous. At over 32 percent, the equity ratio is close to the historical average. The steady expansion of the proportion of alternative investments, which equals between 9-10 percent, is noteworthy. The share of foreign investments has increased noticeably, and for equities, the “home bias” has been significantly reduced over time. Although about one in two francs is now invested abroad, the foreign currency ratio remains stable at around 18 percent.

New allowed categories

Infrastructure investments have been permitted as an independent category since October 2020 according to the BVV2 classification. This allows pension funds to invest up to 10 percent of their total assets in infrastructure. Currently, the share is less than 2 percent. Since the beginning of 2022, pension funds have also been able to invest up to 5 percent in the newly created investment category of unlisted Swiss investments (venture capital). As a result, the Federal Council hopes to see inflows into promising domestic technologies. Although we are seeing interest in infrastructure and private equity asset classes, the share is around 1.6 percent and 2.7 percent, respectively, which is still low. We consider the share of venture capital in private equity investments to be extremely low.

Risk capacity is crucial

Although a trend towards fewer liquid investments is emerging due, in part, to the negative/low interest rate environment, we do not expect a sharp increase in infrastructure, private equity and venture capital. This is because the investment mix also depends on the risk budget, which in turn is influenced by the liabilities of a pension fund. Changes in the law, therefore, do not automatically lead to increased use of new asset classes. The extension article also allowed pension funds to deviate from the statutory limits. In addition, it is important to take into account the delayed build-up of illiquid categories and strong performances of equity markets. Determining the investment strategy – depending on the risk capacity – is one of the key tasks of management bodies. Pension funds are therefore well advised to periodically determine the risk budget by means of ALM studies and, taking into account the developments on the commitment side, to examine investment strategies and to test them, inter alia, by means of stress scenarios.

Contact

Further information on the Risk Check-up Study as well as the last study edition can be found here. For further details, please contact Oliver Gmünder (R) and Andreas Rothacher (L) as authors of the article and part of the Risk Check-up study management.

Contact: riskcheckup@complementa.ch