Investment Consulting

Navigate to... > Overview > ALM Studies > Manager Selection > Sustainability > Governance > Peer Group Comparison > Training > Centers of Excellence

Overview

The defining success-factors of your investment activities include a customized asset allocation, the careful selection of investment managers and an efficient as well as effective investment organization. Our investment consultants bring their experience and knowhow to the table so that those in charge can fulfil their responsibilitees in line with regulations and guidelines.

ALM Studies

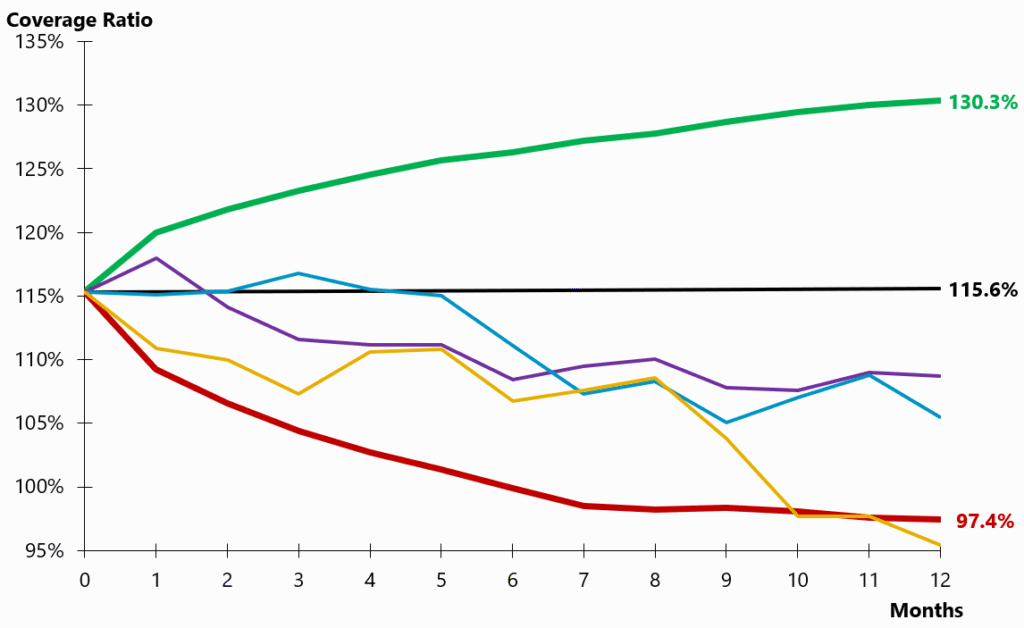

The investment strategy is developed taking into account individual goals, risk capacity and risk tolerance and is reviewed based on both historical and scenario-based stress tests. Working together with the client, our consultants determine the relevant investment universe through the inclusion or exclusion of specific investment categories, whereby further regulatory restrictions or constraints from the investment regulations may also be taken into account. Strategy optimization takes into account the risk budget (e.g. coverage ratio minimum), the non-normal distribution of returns and non-linear dependencies between investment categories. We break down risk and performance drivers and analyse sensitivities (e.g. equities, interest rates/credit, illiquidity, real estate and FX).

Our dynamic ALM approach with its customizable development scenarios offers decisive advantages for future-oriented analyses: We add value by using investor-specific scenarios to examine changes and developments on the liabilities side in greater depth, rather than focusing solely on optimizing the investment strategy.

Manager Selection

Based on principles and criteria defined with the client, our investment consultants identify suitable asset managers and products in all asset classes. The starting universe of our databases contains more than 8,600 products approved for the Swiss market. Our structured and transparent process includes needs-based quantitative analyses, qualitative assessments, direct exchange with asset managers, presentation of the analyses and moderation of the finalist presentations (beauty contests).

The projects are carried out by the experienced consultants of the respective centers of excellence, providing support to clients in the subsequent process as well. As an independent provider, we act free of conflicts of interest at all times. As a result, our clients benefit from objective, meaningful analyses and a solid basis for decision-making.

Sustainability

More and more investors ask themselves how to incorporate sustainability aspects into their portfolios. Our investment consultants advise management bodies in the development of an ESG concept, its implementation and measurement (ESG reporting).

Governance

The support provided by our consultants extends to the conception of your investment organisation. This includes regulations, concepts, guidelines and leadership aids, but also the organisational structure with commissions and committees as well as the organisational assignment of service provides. In addition, we determine the investment philosophy (e.g. active vs. passive) for implementation with those responsible. We support clients in the assessment and review of custody banks and present investments as well as in the training of decision makers.

Peer Group Comparison

Complementa has an extensive database, knowledge and experience to produce accurate and meaningful peer group comparisons for all asset classes. As a result, our clients are able to critically assess the performance of their portfolio and identify potential for improvement and corrective action. We rely on thousands of data points for comparisons with actual implementations with regard to performance and costs, taking into account asset size and investment style.

Training

We conduct targeted and specifically compiled training courses for decision makers. Our team of investment consultants covers the full range of topics relevant to investment management. We are also periodically active in education and training in the form of workshops for foundation boards, both for newly elected and experienced board members.

Centers of Excellence

We pool the knowledge and experience of all asset classes and other subjects in our centers of excellence.

- ALM Studies & Investment Strategy

- Governance

- Sustainability (ESG)

- Fixed Income & Mortgages

- Convertible Bonds

- Insurance Linked Securities

- Equities

- Real Estate

- Infrastructure

- Private Markets

- Hedge Funds

- Commodities

- Multi Asset

- Risk Management

Projects such as manager selections or product evaluations are led and carried out by the consultants of the respective center of excellence. Clients thus benefit from the latest expertise and experience delivered by a team of experts with an open approach.

SAA & ALM Studies

SAA & ALM Studies Manager Selection

Manager Selection ESG Aspects & Concepts

ESG Aspects & Concepts