Swiss pension fund landscape and regulation of alternative assets

The Swiss pension system is based on three-pillars. Public pension provisions in the form of a pay-as-you-go scheme (old-age and survivors’ insurance) constitute the first pillar of this pension system. The second pillar is an occupational benefits scheme (BVG), where employees and employers contribute to individual retirement accounts. This money is then invested in the capital markets. Accrued benefits are portable from one employer to another one. The third pillar is based on tax-advantaged private pension savings on a voluntary basis (offered by banks or insurance companies). In the following article, we will focus on the second pillar of the Swiss pension system and their allocation to alternative investments from a past, present, and future perspective.

According to the Swiss Federal Statistical Office, there were 1’353 pension funds in Switzerland at the end of 2022, with AuM of CHF 1’066.1 billion (bn.) [1]. Swiss pension funds are regulated according to the guidelines and limits stipulated by the Ordinance on Occupational Retirement, Survivors’ and Disability Pension Plans (BVV 2). In the context of the investment guidelines, it must be noted that real estate is classified as a traditional asset class and has its own quota of up to 30% [2]. Alternative assets have a stipulated limit of 15%. Since 2022, infrastructure has its own stipulated limit of 10%, separate from other alternative assets [3]. Pension funds can exceed the stipulated limits, but must justify their decisions to the supervisory authority (Occupational Pension Supervisory Commission).

The following explanations and figures are based on a Swiss pension funds study conducted annually by Complementa AG.The latest 2024 study surveyed 445 Swiss pension funds with assets of CHF 808.9 billion. The study covers one third of all pension funds in Switzerland and 70% of total pension fund assets.

Historical development of Asset Allocation and Drivers

Like other investors Swiss pension funds were faced with low interest rates on their fixed income securities for over a decade until 2022. From 2014 onwards, the environment was particularly challenging as Swiss franc government bond yields fell permanently below 1% and subsequently turned negative.

Yield to Maturity of various Government Bonds (20 years to June 2024)

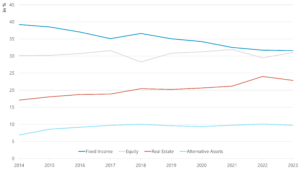

Low interest rates have led many pension funds to adjust their asset allocation over time. The key driver of these changes was the substitution of fixed income investments with other sources of return, without significantly increasing expected volatility. This is clearly reflected in the equity allocation over time.

The long-term comparison shows that the average equity exposure has fluctuated around 30% over the past decade. The capital-weighted average fixed income allocation decreased from 39.5% in 2014 to 31.6% in 2023. The allocation to real estate and alternative assets has increased significantly over the past ten years. In 2014, the allocation to alternative investments was 6.9%. Since 2017, the exposure to alternative investment has fluctuated around the 10% mark. At the end of 2023, the capital-weighted average quota was 9.7%. Over the past ten years, we have also seen a significant increase in the average real estate allocation. The exposure increased from 17.1% in 2014 to 22.9% in 2023 and has remained above 20% for the last six years.

Swiss pension funds have a clear preference for Swiss real estate, especially for the residential sector. This highlights the desire to substitute some of the fixed income allocation with cash flow generating real estate (core assets). Only around one sixth of the real estate allocation is invested outside Switzerland. An important driver for the real estate investments abroad was the lack of suitable investment opportunities in Switzerland. On the other hand, the challenges for such investments include currency risks or currency hedging costs and the high share of commercial sector investments compared to Switzerland. In addition, the risk profiles may differ significantly from the Swiss real estate investments.

Current asset mix and composition changes over time

Compared to ten years ago, the current asset allocation mix is much more diversified. At the same time, it is more illiquid, and the complexity of the average pension fund portfolio has increased over time. For this reason, liquidity management and planning as well as continuous education of pension fund managers and investment committees is a key consideration.

As mentioned above, the allocation to alternative investments has fluctuated around the

10% mark since 2017 (9.7% in 2023). However, a closer look at this quota and the different subsegments reveals that the composition of the alternative assets has changed substantially over time. Over the past few years, we have seen a significant increase in infrastructure and private equity investments. At the end of 2023, each of the two sub-categories represent 2.5% of the overall asset mix (capital-weighted average allocation). Together, these asset classes represent half of the allocation to alternative assets. Over the last five years, infrastructure has increased from 1.4% to 2.5% and the average private equity quota fluctuated between 2.1% and 2.7%.

On the other hand, the average capital-weighted allocation to hedge funds and commodities has decreased significantly. The average hedge fund quota currently stands at 1.1%. At its peak in 2007, the average quota stood at 3.4%. By the end of 2023, the allocation to commodities was 1.0%. At its peak in 2012 and 2013, it was 1.9%. It should also be noted that the remaining quota mainly constitutes of gold allocations.

The alternative asset allocation also includes a 0.8% allocation to insurance-linked securities (capital-weighted average). This quota has stagnated over the last three years. Private debt represents 1.4% of the overall asset mix. Over the last five years this quota has fluctuated between 1.4% and 1.5%.

Currently, around 80% of Swiss pension funds invest in at least one sub-category of alternative assets. Thirteen percent of pension funds have allocated more than 15% to alternative assets (including infrastructure).

- The breakdown by sub-category shows that infrastructure is currently the most popular sub-category in terms of share of pension funds invested. Half of all Swiss pension funds invest in infrastructure. This is a significant increase from around 15% ten years ago (2014).

- Around 44% of pension funds have an allocation to private equity, making it the second most popular sub-category. Especially larger pension funds tend to allocate to this asset class. Smaller pension funds sometimes find it difficult to gain access to private equity due to the complexity of the asset class, resource constraints, cost considerations, fees, sufficient manager diversification, and operational hurdles.

- Around 29% of the pension funds have an allocation to insurance-linked securities. This share has decreased marginally since 2020.

- Between 2010 and 2013, around half of all pension funds invested in commodities. By the end of 2023, a quarter of pension funds invested in the asset class.

- A quarter of pension funds have an allocation to hedge funds. This share has been declining since 2010. Between 2007 and 2012, more than half of all pension funds had an allocation to hedge funds. Important drivers for the decrease were the disappointing performance of the asset class in the 2008 crisis and beyond, cost considerations (e.g. high management fees and performance fees), and freeing up the alternative asset budgets for other sub-categories.

- About a quarter of the pension funds have an allocation to private debt. For reference, ten years ago only around 8% of Swiss pension funds had an allocation to private debt.

These shifts in allocated capital and number of pension funds invested in each sub-category also showcase that Swiss pension funds are making an active effort to manage costs and complexity and are diligent in ensuring compliance with statutory investment guidelines.

Current environment and outlook

Almost one third of the asset mix of Swiss pension funds is currently invested in illiquid and/or complex assets (22.9% in real estate, 9.7% in alternative assets). Therefore, the importance of liquidity management should not be underestimated. The increasing complexity of pension fund portfolios also means that continuous education for pension fund staff and board members will remain essential in the future. In addition to continuous education, it may also be beneficial to hire external specialist, such as investment consultants, to complement existing expertise. After all, mistakes made in the selection process of alternative managers, particularly in private market assets, can be costly or even irreversible.

A major challenge for Swiss pension funds is the currency risk and the cost of hedging foreign exchange risks. This is particularly problematic as the Swiss franc tends to appreciate during financial market crisis. In practise, this can mean that losses on underlying risky assets during market downturns occur in parallel with currency losses. By 2023, Swiss pension funds on average invest almost half of their assets abroad. Our study shows that, on average, pension funds have hedged about two-thirds of their currency exposure over the past few years. Of course, currency risks and hedging costs are not limited to alternative assets. In the alternative asset space, this can be challenging for lower-yielding sub-categories and foreign core real estate investments.

In terms of the future development of alternative assets, we would expect the total allocation (including infrastructure investments) to continue to fluctuate around the 10% mark, especially if the real estate quota stays above 20%. The composition of alternative assets may continue to change. Infrastructure investments could continue to grow, but at a slower pace than in previous years. For private equity, the future development will also depend on the normalisation of private equity markets and transaction markets (in particular exit activity). Future interest rate developments will also be important, as higher interest rates could make alternative assets less attractive, while lower interest rates could increase the need for fixed income substitutes.

Article published on CAIA blog in November 2024.

Author

Andreas Rothacher, CFA, CAIA

Senior Investment Consultant & Head Investment Research

[1] The current population of Switzerland is 8.8 million.

[2] In our pension fund study and in this article, real estate will be treated separately from other alternative assets.

[3] From an economic point of view infrastructure assets would still be considered alternative assets.