Nowadays, it is hard to imagine the investment process of institutional investors without considering sustainability. In particular, the decarbonisation of portfolios is a central point of discussion.

In this brief overview, we show examples of how sustainability can be taken into account in equity portfolios and what implications this may have for portfolio composition, stock concentration and other portfolio factors. We also outline key considerations that investment managers should ask in connection with ESG.

Depending on the size of the equity portfolio, investors have different options to choose from. For large investors, Mandates with individual investment restrictions provide the opportunity to implement the desired sustainability concept for equity portfolios. Such an option is not available to smaller investors to the same extent (especially if cost considerations are taken into account), as investments are usually implemented more cost-effectively by means of collective investments. In consequence, such institutional investors need to look for a collective investment solution that best meets their own sustainability objectives. We deem discussions with the investment team and investment committee ahead of implementation appropriate.

For small investors, it might be suitable to draw on existing ESG indices such as the MSCI ESG Universal or MSCI ESG Leaders. They make use of different methods (e.g. alternative weightings, stock exclusions or best-in approaches) to target an improvement of the respective ESG metrics. The selection of index constituents for the MSCI Sustainability Indices are based on MSCI ESG Research data. The exemplary indices listed below may be the starting point for individually designed ESG implementations.

The MSCI ESG Universal Indices use an alternative weighting scheme which differs from the market capitalisation weighting. The objective is to overweight highly ESG-rated stocks and securities which have progressed furthest in terms of ESG Rating. In addition, selective exclusions are applied.

The MSCI ESG Leaders Indices apply the best-in-class method. For each sector, only stocks with an above-average ESG rating within the respective sector are included in the index. Accordingly, only a maximum of 50 percent of companies per sector are considered. As a result, the number of stocks in this sustainability index is significantly lower than in the parent index.

There are also a number of other sustainability indices focusing on reducing carbon emissions for instance. One example is the MSCI World Climate Paris Aligned Index, which has a shorter live track record (as of 26 October 2020). The index is intended to reduce exposure to climate risks and related transformation risks.

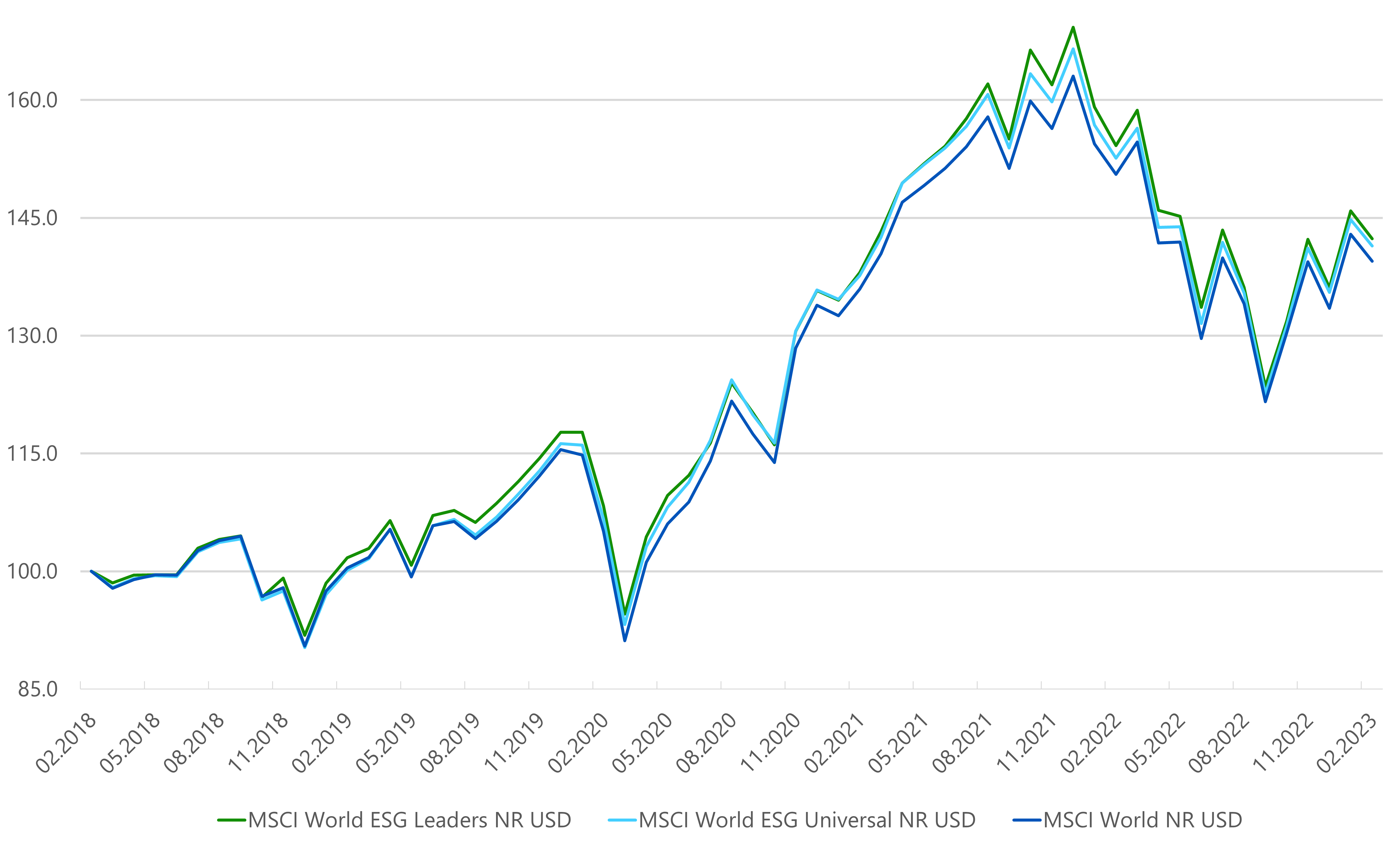

The implications of choosing a sustainability index are illustrated below by taking the MSCI World, MSCI World ESG Universal and MSCI World ESG Leaders indices as examples.

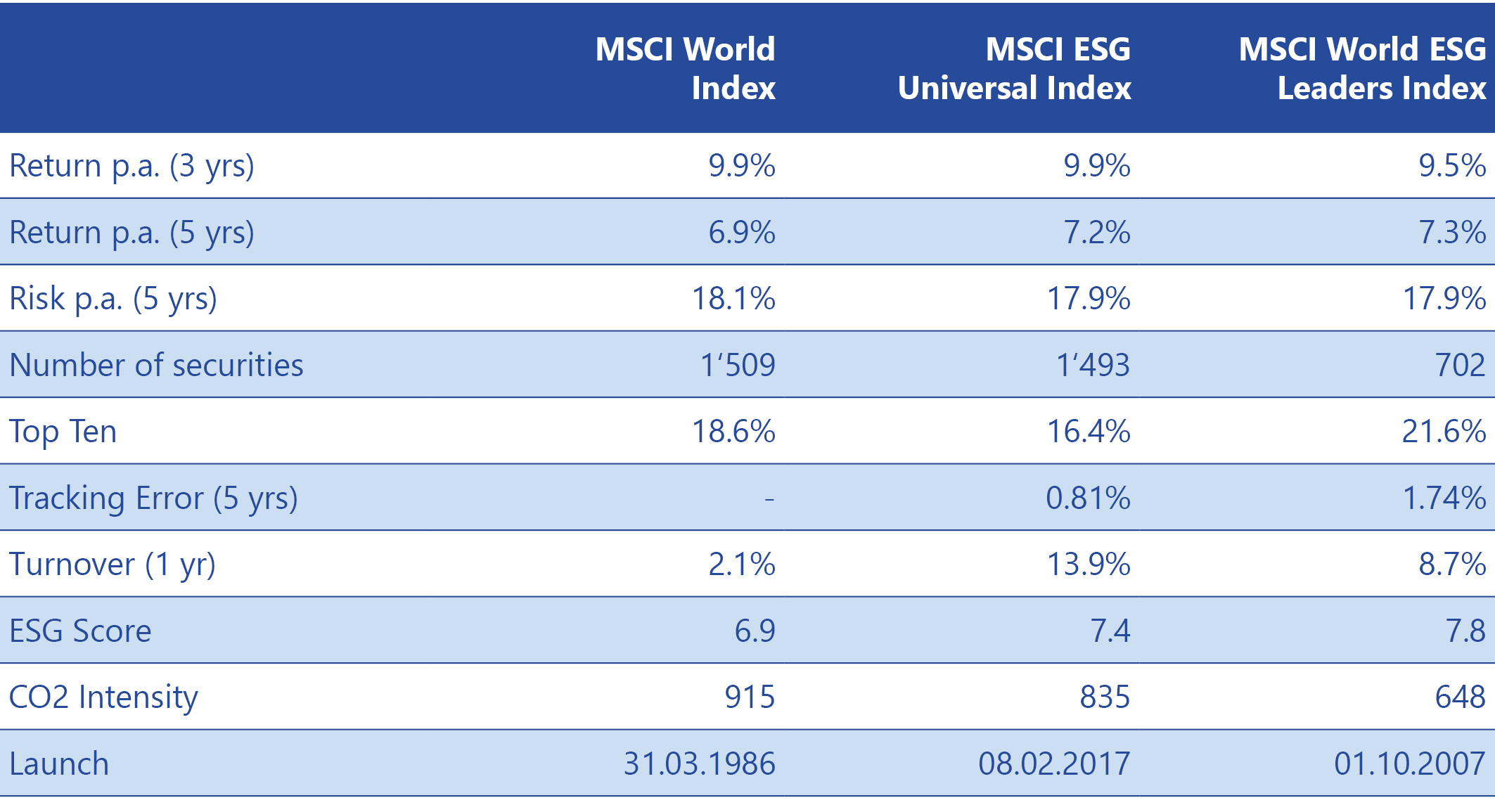

The returns of the indices listed are in a similar range over three and five years. Over a five-year period, the two ESG indices were slightly ahead of the parent index MSCI World, while over a three-year period the return was similar or slightly lower. The risk in terms of volatility was comparable. The table above also shows that the stock turnover within the respective sustainability index increases significantly. Turnover increases by a factor of four or more.

The use of best-in-class approaches and exclusions reduces the number of stocks in the investment universe. In the case of the MSCI World ESG Leaders and MSCI World Climate Paris Aligned, the number of securities is reduced from some 1,510 to around 700 and 650 respectively.

The deviating stock and/or sector weightings contribute significantly to the increase in tracking error. Tracking errors between 0.80% and 1.75% were recorded for the indices discussed here over the last five years compared to the MSCI World. In the case of the MSCI World Climate Paris Aligned Index, a tracking error of around 2.2% compared to the parent index has been observed since its launch (26 October 2020).

For the MSCI World ESG Universal Index, the CO2 intensity decreases by about -10%, while for the MSCI World ESG Leaders Index a reduction of about -30% is achieved. For the MSCI World Climate Paris Aligned Index, the CO2 intensity is approximately halved.

It is important to note that investors may incur additional costs, for example due to the licensing of index data and the higher portfolio turnover, especially compared to passive implementations of broad-based market indices.

Investors need to balance restriction of the investment universe, tracking error and sustainability efforts. For example, excluding energy stocks was very detrimental in 2022, as the energy sector was the only sector to generate a positive return in that year. In other years, however, an exclusion was beneficial. It is crucial that institutional investors are aware of any sector deviations. It is also important to bear in mind that excluding stocks from the portfolio can improve ESG indicators. At the same time, however, the voting rights associated with a share are forfeited and with it the option of exerting influence on a corporation.

These considerations should be made by the investment managers and require a discussion prior to implementation to bring common understanding and goals regarding ESG to the table. The discussion should include the following questions: What is the goal to be achieved? How is the respective sustainability impact to be measured? What tracking error is to be accepted? What are the costs/additional costs that arise?

Summary

The complexity of ESG in the investment context and its implications should not be underestimated. In addition to limiting the investment universe and possibly reducing diversification, other implications of ESG implementation must also be taken into account, such as sector deviations (intentional or unintentional), ESG impact, tracking error considerations and implications for portfolio monitoring (e.g. by means of ESG reporting). Besides the consideration of sustainable indicators, traditional assessment criteria and indicators must still be taken into account.

Authors: Valentin Dietschweiler & Andreas Rothacher