In 2023, the Magnificent Seven (shares of Apple, Amazon, Alphabet, Nvidia, Meta, Microsoft and Tesla) stood out due to their high performance and increasing weighting in various equity benchmarks. Index concentration has not only risen in the S&P 500 but also other global equity indices.

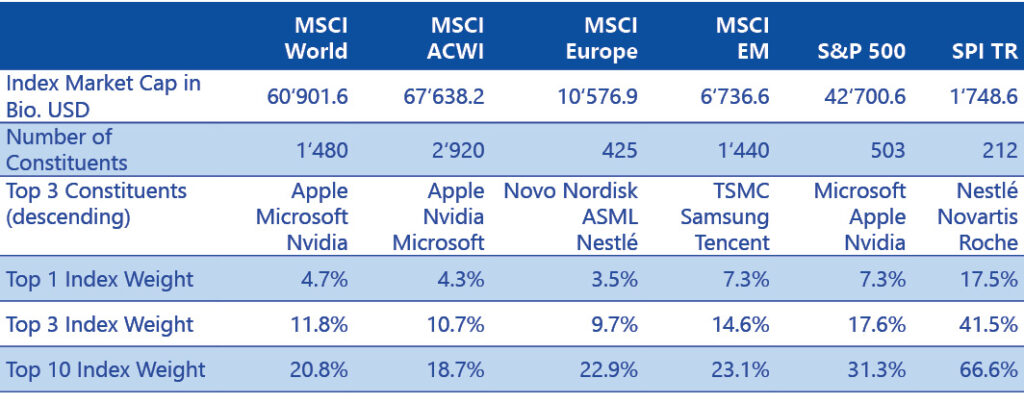

The table clearly shows that high concentration of index heavyweights is not limited to the S&P 500 Index (the top 10 stocks account for around 31% of the index’s market capitalization). In the MSCI World (equity market for the developed countries), the weighting of the top 10 is around 21%. In the MSCI Emerging Markets, the top 10 stocks account for around 23% of market capitalization, while in the MSCI Emerging Markets Asia, the weighting of the top 10 is around 30%.

The index concentration is particularly pronounced in the Swiss Performance Index (SPI TR). Here, the index heavyweights Nestlé, Novartis and Roche together make up almost 42% of the SPI index. The top 10 stocks account for around two-thirds of the index’s total market capitalization. In 2023, the risks of such an index concentration became apparent. Two of the three index heavyweights (Roche and Nestlé) recorded significant losses over the course of the year, which also weighed on the total performance of the index.

However, it should also be pointed out that in terms of total market capitalization the Swiss equity index is much smaller than the S&P 500 or various MSCI indices. If the Swiss index is compared to other country indices of comparable economies, the index weights are not so unusual. For example, the index heavyweights ASML, Shell and Unilever together account for almost 46% of the AEX index (Dutch equity index). The country index in Denmark is also relatively concentrated. Novo Nordisk accounts for almost two thirds of the market capitalization of the MSCI Denmark, while the second-largest position in the index has a share of less than 6%. For investors with the euro as a base currency, this could imply that it is better to rely on the MSCI Europe (or STOXX Europe 600) instead of a single country index. The index heavyweights Novo Nordisk, ASML and Nestlé account for just under 10% of market capitalization here (MSCI Europe).

What can institutional investors do?

What measures and options do investors have to counteract the concentration of securities in various equity indices and how should index concentration be dealt with? We have listed and explained various options and approaches below.

Looking at individual stock exposure in the overall portfolio context

At first glance, the values listed above appear relatively high. At the same time, most institutional investors also invest in other assets in addition to equities. Apple has an index weighting of around 4.7% in the MSCI World. An investor who has strategically defined a global equity allocation of 20% and implements this passively would therefore have an exposure of around 0.95% to Apple shares at overall portfolio level. If the price of this stock were to fall by 10%, this would correspond to a negative performance contribution of around -0.1% to the total return.

Exposure to individual stocks should be viewed not only at the level of the equity allocation, but also in the overall portfolio context. At the level of the overall portfolio, the exposure to the respective corporate bonds must also be taken into account, although their volatility tends to be much lower (especially for issuers with a high ratings).

Investors should be aware of the index composition

The benchmarks defined during strategy development represent the available opportunity set of an asset class. Passive investors should also regularly examine the index composition of the selected benchmarks and index funds. A periodic discussion should help to ensure that investment managers are aware of changes in the index composition and characteristics and any concentration trends. Subsequently, it should be discussed whether one is comfortable with the current index composition and wants to continue investing in this way.

Diversification across different equity markets

Diversification into other equity markets can offer a further opportunity to moderate the portfolio allocation to the index heavyweights. For example, an American investor could supplement his allocation to the S&P 500 with an investment in the Russell 2500 (US Small and Mid Cap Index). This can be done strategically with a separate target quota or in the form of a core-satellite approach (sub-category of equities).

When investing in other markets, it is important to bear in mind that the characteristics of other equity markets may differ significantly from the home market or the initial market. This applies not only to the composition of stocks, but also to the sector weightings, style exposures and, depending on the case, the market capitalization and, as a result, the risk/return characteristics.

For example, a Swiss investor could supplement his Swiss equities portfolio with an allocation to the Small and Mid Cap Index (SPI Extra TR). The weighting of the top three stocks here is around 13%. At the same time, such an investment would lead to a change in the sector allocation (including a lower proportion of the healthcare sector and a higher proportion of industrial stocks) and an increase in economic sensitivity. The investment managers should first develop an awareness of the quantitative and qualitative changes in the investment characteristics of the equity allocation.

Diversification across different asset classes

Institutional investors are well advised to consider other asset classes such as real estate and alternative investments in their strategic asset allocation in addition to their traditional investments such as equities and bonds. In addition to the differing risk/return characteristics, fees, greater complexity and possibly also illiquidity must be considered. It may be necessary for investment managers to build up knowledge of new asset classes first or to seek the help of an external specialist such as an independent investment consultant before building up exposure to a completely new asset class. It should also be noted that not all institutional investors have equal access to alternative investments. This may be due to regulatory restrictions, liquidity preferences or size restrictions (e.g. minimum investment amount).

Using a bandwidth concept and carrying out disciplined rebalancing

The skillful use of investment bandwidths can help to take profits at the right time. Rebalancing helps to ensure that the effective allocation is close to the defined investment strategy and its risk/return characteristics.

Narrower bandwidths generally mean that the momentum of an asset class is capped earlier. It is therefore a balancing act between participating in market momentum and risk management.

Evaluate the use of active managers

Depending on the specific equity market, it may make sense to supplement the portfolio with one or more active managers (core-satellite approach). In addition to the expected tracking error, the manager selection risk, the higher costs, and the expected net performance must be kept in mind. When evaluating active managers, investment managers should also carefully assess the diversification potential of a product based on correlation analyses and portfolio holdings. Otherwise, adding an additional manager will not help to reduce the concentration of securities within an asset class.

Diversification must not be an end in itself

It is important to us to point out that diversification should not be pursued for its own sake. The inclusion of additional asset classes and the different stock weighting of an equity investment should have the potential to reduce the portfolio risk or increase the return potential (or a combination of both elements).

An illustrative example of this is the MSCI World Equal Weighted Index. Compared to the MSCI World, the equal weighted index achieved lower long-term returns over various periods.

A comparison of the rolling three-year returns (annualized) shows that over a period of 20 years (February 2004 to January 2024), the cap-weighted index outperformed the equal-weighted index in more than two-thirds of all cases. The volatility of the equally weighted index was also higher.

Accordingly, the Sharpe ratio was also lower over the longer term. Turnover and the associated transaction costs were also significantly higher compared to the capital-weighted approach. With this approach, investors may also be overweighted in companies that perform comparatively poor and therefore have a low market capitalization (albeit with lower average price/earnings ratios).

In the short term, there have always been brief phases in the past when the equal-weighted approach has outperformed the capital-weighted approach. However, this speaks more for a tactical use of such products and not for a strategic use.

Summary

Institutional investors are well advised to periodically review the composition of their portfolios and develop an awareness of the composition of the defined benchmarks.

This also remains relevant for investors who implement various market segments passively.

A periodic review of the investment strategy by means of an asset-only study or ALM study can help to keep your own portfolio on track in the long term and achieve the set investment goals.

Download: You may download the article here.

Authors

Andreas Rothacher & Valentin Dietschweiler

Disclaimer

The information contained in this document was collected, analyzed and prepared with the customary due diligence. Nevertheless, Complementa assumes no liability nor does it offer any guarantee on the completeness, accuracy or timeliness of data or any other aspects of the information contained herein, despite the fact that Complementa selected data sources and media, who it considers reliable, to the best of its knowledge. Moreover, Complementa itself depends to a considerable degree on the quality of the information supplied to it by the data owners.

This document may contain forward-looking statements based on planning, estimates, forecasts, expectations, certain assumptions and currently available information. The forward-looking statements are not to be interpreted as a guarantee for future developments and results. These are rather dependent on many factors including a variety of risks and uncertainties and are based on assumptions that may not prove relevant. Complementa does not undertake to update forward-looking statements.

This document and the information herein is for informational purposes only, and its herein proposed alternatives shall not without thorough examination by the recipient be construed as a solicitation to conduct certain transactions or select a certain business partner, broker, etc. It does not relieve potential investors from making their own comprehensive assessments, especially with regard to tax and/or legal issues. None of the information is to be construed as a recommendation to enter into or refrain from particular transactions or business relationships. The content does not constitute an offer to invest in any

kind of products.