Deteriorating economic conditions saw Swiss pension funds return on average -10.7% for the year to end-September.

Download the article (IPE November 2022, Country Report Switzerland)

The year 2021 was an impressive one for Swiss occupational pension funds, the country’s fully funded second-pillar system. The average return stood at 8.3%. Thanks to the high returns, pension schemes were able to build reserves and grant additional interest accrual on vested pension benefits. The average coverage ratio increased to over 115% by the end of 2021, which is around five percentage points higher than at the end of 2020. As of December 2021 (figure 1), only 2.4% of Swiss pension funds were underfunded, the lowest value in the last 20 years.

2021: a blessing for employees

Employees profited strongly from last year’s high returns. On average, their pension capital rose by 3.8%, a level last seen two decades ago. This is significantly above the statutory minimum interest rate of 1%, set by the federal council, as well as the average of 2.4% per annum in the past 20 years. Nine out of 10 pension schemes provided their active insured members with an interest rate above the minimum requirement. A few pension schemes even granted an interest rate of over 10%. Therefore, it is not surprising that last year’s interest rates for the employed varied widely between pension schemes. Pension funds that did not grant an interest rate above the minimum requirement, had an average funding ratio 5.7 percentage points below median and the average return was 1.4 points below the median return of the entire peer group.

Significant market downturn impacts pension schemes

In 2022 the situation is quite different. Markets are facing various challenges, including high inflation rates, geopolitical turmoil and supply chain disruptions, to name a few. The more restrictive monetary policy is also negatively impacting stock and bond valuations. As a result, pension funds are confronted with falling bond and equity prices at the same time. As of end of September 2022 the average return stands at -10.7%. Hence, 2022 is currently performance-wise the second-worst year in the last 20 years after 2008 (-12.8%). Consequently, coverage ratios have been decreasing and the number of underfunded pension funds increased to 8.5% by the end of August. Since performance in September was negative as well, we expect this number to increase further. As of end of September the average funding ratio stands at 101.5%. Reserves built up in 2021 and previous years suffice (at the time of writing) to mitigate the current volatility and market downturn.

Gap between statutory and effective conversion rate

In 2021 the overall conversion rate decreased to 5.4%. It represents the rate at which pension assets are converted into annuity payments upon retirement of an insured person. The effective rate is significantly below the statutory conversion rate of 6.8%, which is only applicable to the mandatory part of the pension benefits for annual salaries of up to CHF86,040 (€87,961). Obviously, conversion rates on the non-mandatory benefits are significantly lower. We expect a further decrease to below 5.2% in the coming years. However, the decline will be less pronounced than in previous years. The discount rate for the pension liabilities applied by Swiss pension funds currently stands at 1.6%. The change amounts to -20bps compared with the previous year. This represents a continuation of the downward trend over the last few years. In the context of rising interest rates, it is too soon to predict whether we will see a reversal of this trend.

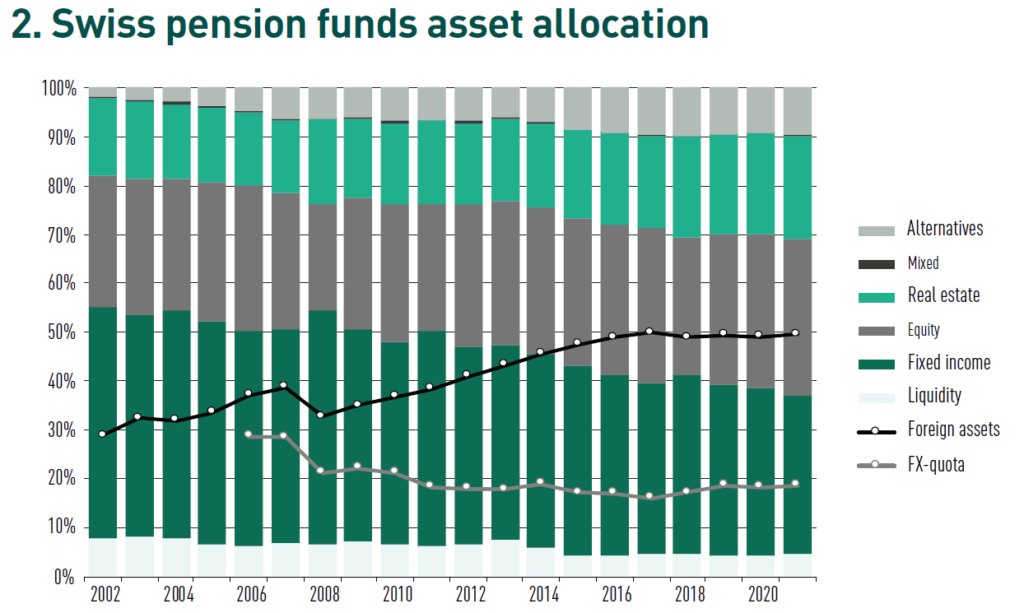

Real estate and alternatives to substitute fixed income

By the end of 2021 fixed income constituted 32.5% of the asset allocation of Swiss pension funds (figure 2). Fixed income is still the largest asset class but with less than one third of pension assets invested in the asset class, we also observe the lowest allocation in almost three decades of data. Thanks to the strong performance of equity markets in 2021 the equity quota has increased. Rebalancing measures have mitigated this increase to some degree, leaving it at 31.9%. In line with the long-term trend, we observe an increase in real estate and alternative investments. For the fourth consecutive year, Swiss pensions funds allocated more than 20% of assets to real estate. The build-up primarily took place in non-domestic real estate, as pension funds struggled to find enough investable domestic real estate investments. Alternative assets remained above 9% of the investment mix for the sixth consecutive year. Private equity and infrastructure are the most popular subcategories. In the past five years, we saw the percentage of pension funds with infrastructure investments more than double to 43%.

Infrastructure on the rise

The main motivation to invest in infrastructure assets includes the search for higher yields or new sources of return as well as potential diversification benefits. Other reasons include the search for a bond substitute, inflation protection and in some cases ESG considerations. Pension funds that are not invested in infrastructure name illiquidity, high cost, high minimum investment and the complexity of infrastructure investments as the main reasons for their decision. Some pension funds prefer other alternative asset classes or already have a high real-estate quota, which is why illiquid assets should not be increased any further. In addition, there is a minority of pension funds that do not invest in alternative investments. Most invested pension funds plan to hold their current allocation steady but 27% of respondents plan to further increase their allocation. A high percentage of surveyed pensions schemes invest in global solutions. A significant number also invests in Swiss infrastructure solutions. There is a clear preference for infrastructure equity investments compared with debt investments, while a combination of both is common. Regarding investment vehicles, close-ended funds still dominate the asset class but a rising number of pension funds is investing in open-ended funds. The experience of a provider with infrastructure, a relevant track record, portfolio diversification (such as sector and geography) and costs are seen as the key criteria when selecting infrastructure managers. Additional considerations include whether a provider can demonstrate experience with Swiss pension funds and has a local presence. In October 2020 the Swiss pension fund regulation (BVV 2) was amended. The parliament approved the creation of a new category for infrastructure investments separately from the existing alternative asset quota. Our survey reveals that about 60% of pension funds classify infrastructure assets under the new category. About 36% of participants continue to classify infrastructure under the existing alternative investment category. However, 45% of these respondents mention that they plan to reclassify infrastructure assets into the new category. The remaining respondents have infrastructure assets classified in both categories. This might be because some of their products do not fulfill the requirements of the new category. We also received comments from pension funds about the regulatory changes. Many were critical of the new category because it would not create any new investment opportunities.

Challenging environment

So 2021 was an excellent year for Swiss pension funds, which achieved high returns and the average coverage ratio increased significantly. Insured employees profited through high interest rates on their pension capital. However, 2022 stands in stark contrast to the previous year. The tightening of monetary policy and decreasing growth expectations create a challenging environment for pension funds as bond and equity valuations come under pressure at the same time. Coverage ratios decreased significantly, but last year’s accumulated reserves mitigate this development to some extent.

Authors: Andreas Rothacher & Oliver Gmünder